Starting college or living on your own for the first time brings immense freedom—and immense financial responsibility. Managing tuition, rent, groceries, and debt with limited income (often from a part-time job or student loans) is a challenge.

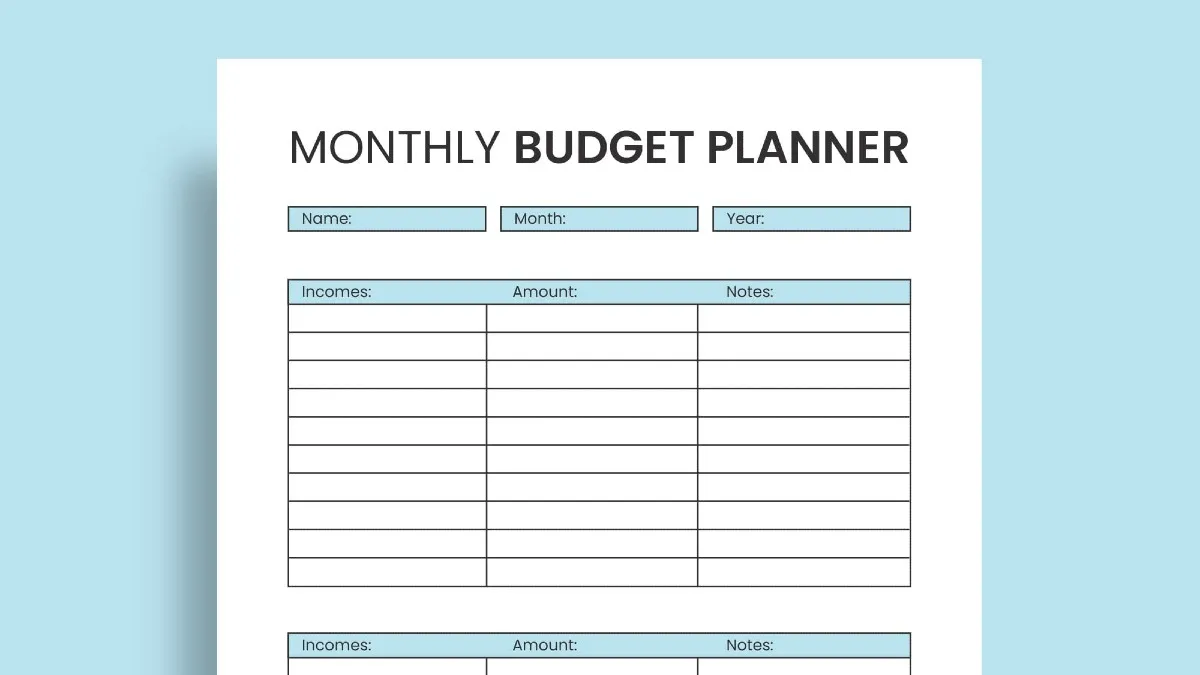

The single best tool you can use to gain control is a simple monthly budget planner. A good budget plan does one thing: it gives every dollar a job, turning your money from a mystery into a clear roadmap.

This guide will introduce you to the easiest budgeting method for student life and provide a simple, free template to get you started today.

The Simplest Method for Students (The 50/30/20 Rule)

While many complex methods exist, the 50/30/20 Rule is the best starting point for a busy student because of its simplicity and flexibility. This method divides your after-tax (take-home) income into three major buckets:

1. Needs: 50%

This is money for essential expenses—the things you must pay for to live and work.

- Examples: Rent or mortgage, tuition, required loan payments (minimum only), utilities (like electricity and internet), groceries, and transportation costs (gas, bus pass).

- Goal: Keep these expenses to about half of your total take-home pay.

2. Wants: 30%

This is money for non-essential expenses—things you spend money on by choice that improve your quality of life.

- Examples: Dining out, shopping, streaming subscriptions (Netflix, Spotify), hobbies, and entertainment (movies, travel).

- Goal: If you need to cut spending to save more, this is the first area you reduce.

3. Savings and Debt Repayment: 20%

This final portion of your income goes toward building wealth and eliminating expensive debt.

- Examples: Building your emergency fund, contributions to retirement (like an IRA or 401(k)), and any extra payments toward high-interest debt (like credit cards).

- Goal: This 20% commitment ensures you are paying your "future self" first.

The Easiest Planner Template (Download)

The best budget is a simple one that forces you to plan before the month begins. You can download this free template and customize it to fit your exact needs.

3 Steps for Using Your Template:

- List Income First: Always list all your income (paychecks, financial aid disbursements, gifts) at the top. This total tells you exactly how much money you have to work with.

- Plan Expenses: Subtract all your fixed monthly expenses (Needs). Then, move to your Savings/Debt goals (20%). What remains goes to your Wants.

- Aim for Zero-Based Intent: While using the 50/30/20 structure, treat your budget like a Zero-Based Budget. This means Income - Expenses - Savings = $0. You are giving every dollar a job so no money sits idle or is spent without intent.

Navigating Student Financial Challenges

Students often face financial situations that differ from a traditional 9-to-5 worker. Here is how your monthly planner can handle those unique challenges.

1. Handling Irregular Income

If you are a freelancer or work shifts that cause your income to change every month, budgeting can be tricky.

- The Solution: Budget based on your lowest anticipated monthly income. If you make more than that lowest amount, the extra cash can immediately be added to your savings or debt payoff goal. Never budget based on a "good month" estimate, which can leave you short during a slow one.

2. Managing Debt Payments

Remember that your minimum debt payments (e.g., student loan minimums, credit card minimums) belong in the 50% Needs bucket. Any additional money you plan to pay to accelerate your debt repayment goes into the 20% Savings/Debt bucket. This keeps your core living expenses separate from your wealth-building goals.

3. The Power of Automation

You can combine your physical budget template with your banking app. Set up an automatic transfer at the beginning of the month to immediately move your 20% allocation into a separate High-Yield Savings Account (HYSA). This ensures you "pay yourself first" before any other bill or spending impulse can derail your goal.

Need Something Simpler? Try Our Budget Allocator

Use this quick calculator to plug in your total monthly take-home income. The tool will instantly show you the exact dollar amounts you should be allocating to your Needs (50%), Wants (30%), and Savings/Debt (20%) buckets, giving you clear targets for the month ahead.

50/30/20 Budget Allocator

Final Takeaway

Setting up a budget is not a restriction; it's an empowerment. It removes guilt from your "Wants" spending and gives you peace of mind that your essential "Needs" are covered. By downloading this simple monthly planner, you take the first, most important step toward financial well-being.