While most brokerage statements give yearly summaries, they often miss the forward-looking forecasts and all-in-one consolidation that serious dividend investors require.

Holding money in a 401(k), a regular taxable account, and an IRA creates fragmented data. Finding a single dashboard that puts it all together is a key need. Picking the right tool helps you watch your cash flow, guess future income, and manage risk.

Why Tracking Dividends Separately is Needed

Basic portfolio tools only show how your stock price performs. A dividend investor requires deeper insight for taxes and reinvestment:

1. The Power of DRIP Modeling

When a company pays a dividend, if you have a Dividend Reinvestment Plan (DRIP), that money buys fractional shares right away. Tracking this process manually is messy. Specialized apps automatically model this compounding effect. They show exactly how your share count will multiply over the next five to ten years.

2. Tax Reporting Detail

Your broker sends a Form 1099-DIV summary. That form does not show when the money landed. For budgeting or figuring out tax-loss harvesting plans, you need to see a day-by-day or month-by-month view. These apps simplify the difference between qualified and non-qualified dividends.

3. Avoiding Account Overlap

If you manage accounts for a spouse, children, or a trust, a combined view helps you track the total dividend income coming into your whole household. This is helpful for household budgeting and estate planning.

Best Tracking Tools for Dividend Investors

The best choice depends on whether you prefer simplicity, deep analysis, or protecting your portfolio income.

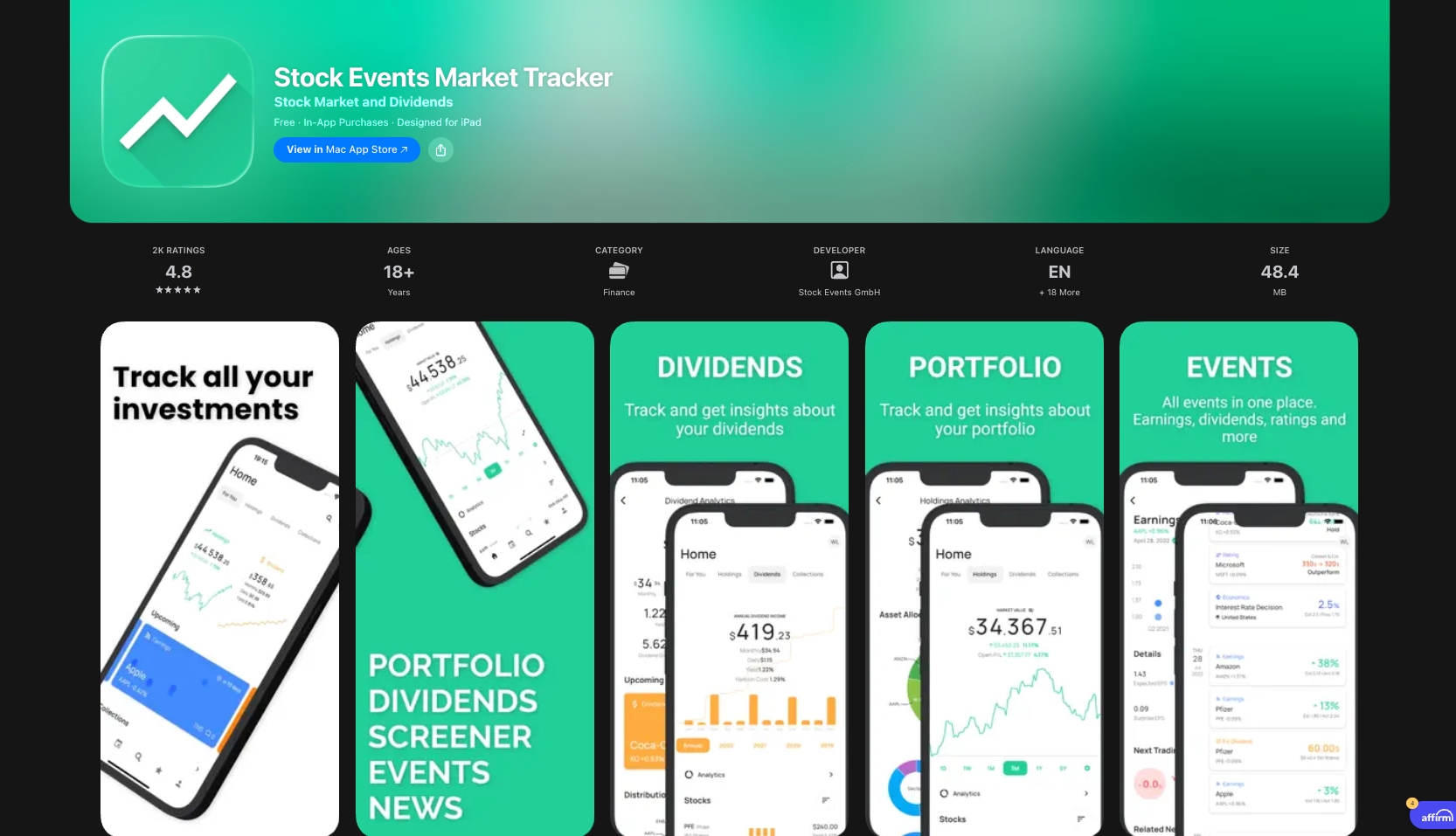

1. Stock Events

The Community Favorite for Simplicity and Projections

Stock Events is widely liked for its clean look and strong visual forecasting of dividend income. It works as the best starting place for anyone needing to quickly combine views from many brokerage accounts.

- Main Strength: The dividend calendar is beautiful. It clearly shows projected payment dates, ex-dividend dates, and income amounts for the entire year. This tool is very useful for planning passive income budgets.

- Best Use Case: Someone new to dividends who mainly wants to know, "When is my next payment due, and how much will I receive this month?"

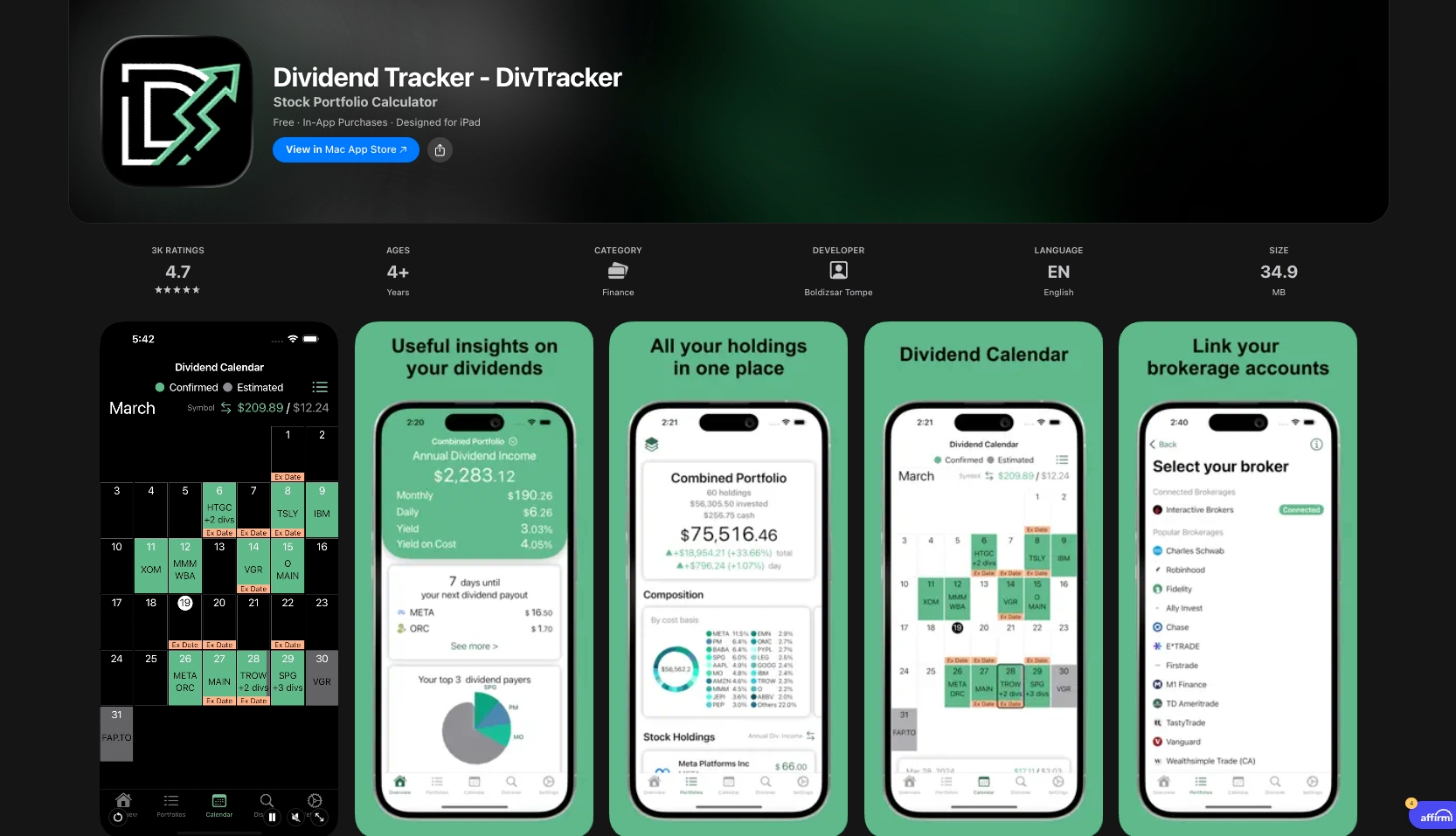

2. DivTracker

Deep Dive for the Committed Dividend Growth Investor

Apps in this group are built specifically for the dividend community. They offer detailed metrics that basic apps miss.

- Main Strength: DiviTracker is great for DRIP modeling, accurately showing how compounding increases your share count and future payouts over time. It tracks the year-over-year dividend growth rate, a key measure for investors trying to beat inflation.

- Best Use Case: An investor who closely watches dividend growth and uses DRIPs. This person needs advanced tools to forecast future passive income.

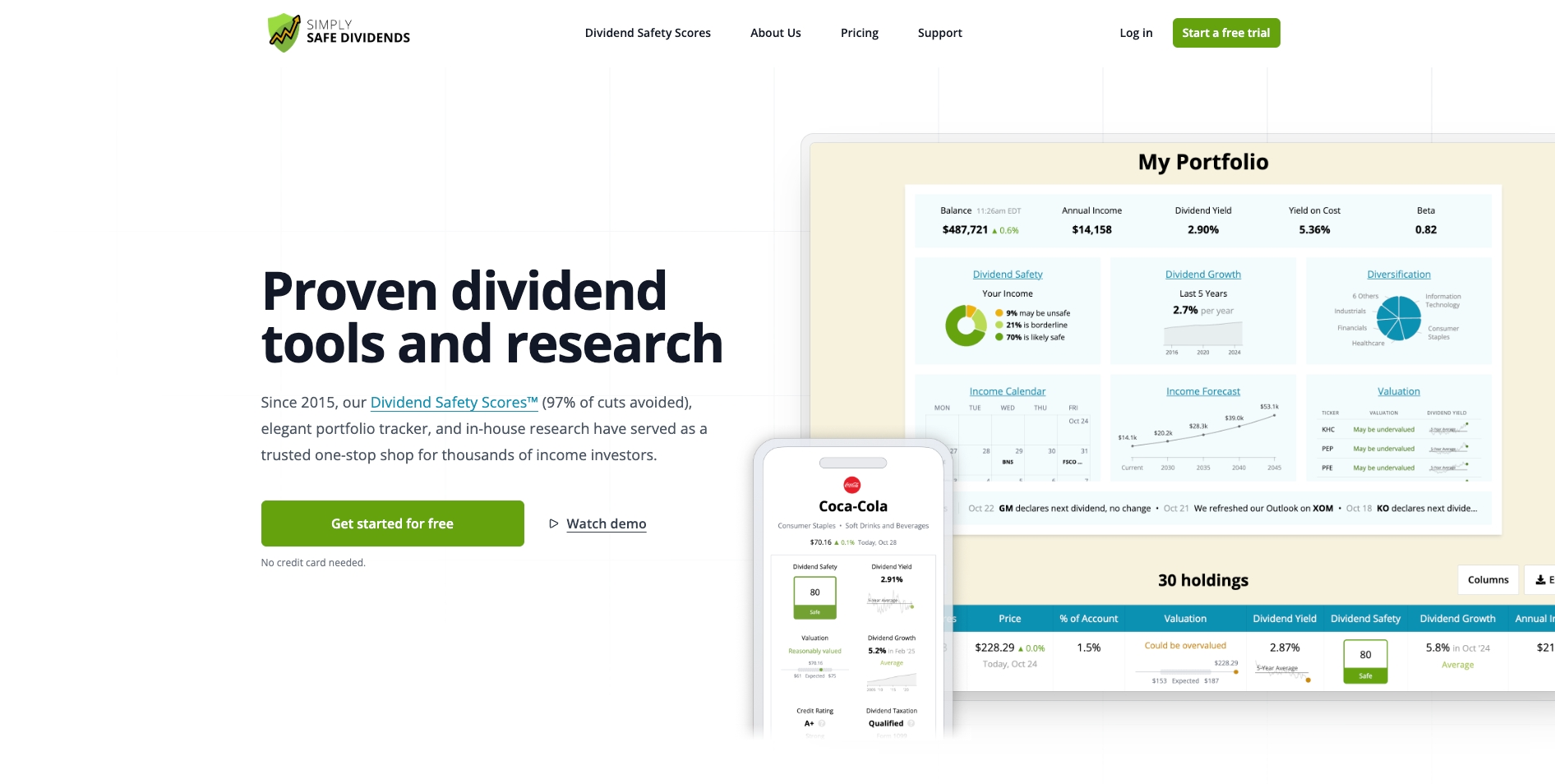

3. Simply Safe Dividends

Best for Portfolio Quality and Risk Management

This service focuses on the safety and reliability of your dividend income. It is a helpful research tool for weeding out risky stocks.

- Main Strength: The platform's Dividend Safety Score (from 0 to 100) is the biggest draw. This score looks at a company’s payout ratio, debt, cash flow, and history to judge the chance of a dividend cut. Knowing this helps you rest easier.

- Best Use Case: Any investor who values steady income over quick stock price jumps and requires assurance their income stream won't suddenly vanish.

4. Personal Capital (Empower Personal Dashboard)

The Best for Total Financial Integration

While it doesn't focus just on dividends, Empower (Personal Capital) is excellent at giving you a complete, free view of your whole financial life, with dividends fitting into that picture.

- Main Strength: It links all your brokerage accounts, bank accounts, credit cards, and 401(k)s. This lets you track total dividends received alongside your overall net worth and retirement projections.

- Best Use Case: The financially organized person who needs to see the entire financial picture and monitor fees across all accounts at once.

Security and Data Access

Linking your financial life to an app naturally raises security questions. Every good dividend tracker uses the same security methods as major brokers.

Read-Only Access

When you connect your accounts (often using services like Plaid or Yodlee), you grant read-only access. This means the app can view your balances and transactions, but it cannot move money, trade stocks, or access withdrawal functions for you. This separation keeps your funds safe.

Tax Reporting Bridge

These apps save hours when tax time arrives. The tools pull all the complicated dividend payments from many different broker statements. They generate a single report of your annual dividend income. This simplifies the numbers needed for your 1099-DIV on your tax form.

Final Thoughts: Match the App to Your Goal

Picking the right app comes down to what matters most to you:

- If you need simple tracking and a good calendar (free): Stock Events is the best way to begin.

- If you need certainty that your income won't be cut (safety): Simply Safe Dividends provides the necessary deep analysis.

- If you want to see dividends as part of your total retirement wealth (net worth): Empower is the best free option available.