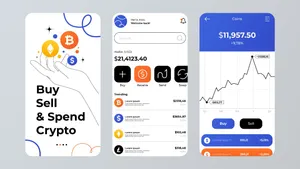

Robinhood pioneered commission-free investing, and that simplicity extends directly to its crypto platform. For a beginner, Robinhood offers one of the fastest, most straightforward ways to buy your first cryptocurrency (like Bitcoin or Dogecoin) using a clean, easy-to-use mobile app.

The primary appeal of Robinhood Crypto is its simplicity and speed. You can complete your first purchase in minutes. However, you must understand its unique, no-commission fee structure and its initial primary limitation (wallet control).

This guide will walk you through setting up your account and executing your first crypto trade quickly, followed by a dive into the fees and limitations.

The Fast-Start Guide (5 Minutes to Your First Trade)

If you already have a verified Robinhood Investing account, the process to access crypto trading is virtually instantaneous.

Step 1: Activate Robinhood Crypto

- Find the Crypto Tab: In the Robinhood mobile app, look for the little "C" icon or the main search bar, and navigate to the cryptocurrency section. You might see a dedicated card on your main dashboard.

- Sign the Agreement: You will be prompted to review and sign a quick user agreement and risk disclosure to activate crypto trading. Robinhood keeps your crypto assets housed within your main investing account, making management simple.

Step 2: Choose Your Coin & Start Order

- Search or Select: In the crypto section, you can either use the search bar to find a specific coin (e.g., Ethereum) or tap on a popular one (e.g., Bitcoin) that appears prominently on the list.

- Review the Chart: Briefly review the coin’s current price, performance chart, and key statistics.

- Start Order: Tap the unmistakable "Buy" button to initiate a new trade order.

Step 3: Enter the Amount and Review

- Enter Amount (Fractional Investing): This is where Robinhood shines. You can enter the dollar amount you want to spend (e.g., "$5.00" or "$100.00"), even if the coin's price is thousands of dollars. Robinhood will automatically calculate and show you the corresponding fractional amount of the coin you will receive.

- Choose Order Type:

- Market Order (Default): This executes instantly at the best available current market price. This is what most beginners use.

- Limit Order: This allows you to set a maximum price you are willing to pay. The order will only execute if the coin’s price drops to your limit.

- Final Review: Check the estimated trade details one last time.

- Submit: Swipe up to submit the order. Your crypto is purchased instantly and will appear in your holdings within seconds.

Robinhood’s Fee Structure: The Hidden Cost of "Free"

Robinhood famously charges a $0 commission for crypto trades. However, this does not mean the trade is completely free. Robinhood makes its revenue on a hidden cost called the spread.

| Fee Type | Description | Beginner Takeaway |

| Commission | An explicit, fixed fee for executing the trade. | $0.00 (None) – This is Robinhood's main draw. |

| The Spread | The difference between the highest buyer price (bid) and the lowest seller price (ask). | The final coin price you receive is slightly marked up from the listed price, and Robinhood keeps that small difference. |

- What is the Spread? Every asset has a bid and ask price. When you buy crypto, Robinhood fills your order at the ask price, which is slightly higher than the price shown on the chart. Robinhood Crypto collects a small portion of that price difference (the spread) as its revenue.

- The Takeaway: While you save on explicit, fixed commissions, the final price of your coin is marginally marked up due to this spread. This practice is common across many "fee-free" brokers.

Limitations for the Serious Crypto User

Robinhood is ideal for beginners and casual investors, but it has key limitations that make it unsuitable for advanced traders or those focused on true self-custody.

1. Limited Coin Selection

- Robinhood only offers a small, curated selection of major cryptocurrencies (Bitcoin, Ethereum, Dogecoin, Litecoin, etc.).

- The Difference: Specialized crypto exchanges like Kraken, Binance, or Coinbase offer hundreds, sometimes thousands, of different tokens, including newly launched altcoins.

2. No Private Key Ownership (Custody Risk)

- The Issue: When you initially buy crypto on Robinhood's brokerage platform, you do not hold the private keys to your assets. Robinhood Crypto, LLC secures your coins in its own corporate wallet. This is known as "custodial holding."

- The Problem: If Robinhood were to face a catastrophic failure or security breach, accessing your assets could be delayed or jeopardized. "Not your keys, not your coin."

3. Transferring to a Private Wallet

- The Solution: The Robinhood Wallet: Robinhood recently launched the Robinhood Wallet, a separate application that acts as a true self-custody wallet. This gives you full, non-custodial control over your private keys.

- The Process: You can transfer your crypto from your main brokerage account to this Robinhood Wallet (or any other external wallet you choose).

- Transfer Fees: While there are no commissions on trades, Robinhood does pass on the network fee (also known as the "gas fee" for certain blockchains like Ethereum) when you send crypto to an external wallet. These fees are paid to the miners/validators securing the blockchain, not to Robinhood.

Final Takeaway

Robinhood is the quickest, most intuitive way to start buying crypto. The seamless mobile experience and the ability to instantly invest small dollar amounts make it perfect for the beginner to gain confidence and exposure to the market.

Use the platform to get started, but remember this critical best practice: transfer any significant long-term holdings to a separate, private wallet (like the Robinhood Wallet or a hardware wallet) to gain true, self-custody control over your digital assets.