Robinhood changed the game. It made investing accessible, simple, and—let's be honest—fun. But that simplicity is a double-edged sword. The app's easy-to-use interface can make investing feel like a game, encouraging behaviors that look more like gambling than long-term wealth building.

This is where many new investors go wrong. They get caught up in the hype, watch the charts all day, and treat the stock market like a casino.

The good news is, you can use the exact same app for responsible, long-term success. It's all about switching your mindset and using the right tools. Here are the 5 most common beginner investing mistakes on Robinhood and how to fix them today.

Mistake 1: Treating It Like a Casino (aka Day Trading)

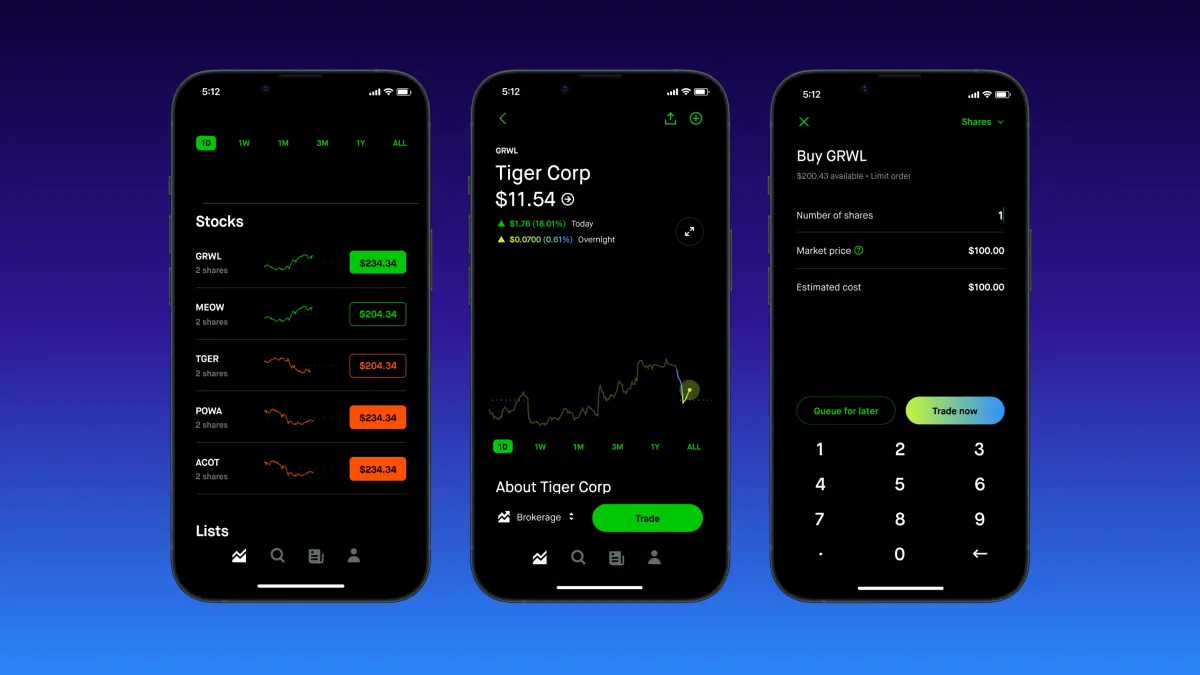

The Problem: The app's "1D" (1-Day) chart is the default. The colors, the fast-moving ticker... it all encourages you to do something. This leads to day trading on Robinhood, where you buy a stock in the morning and sell it in the afternoon, hoping to scalp a tiny profit. This is not investing; it's gambling, and it's a proven way to lose money.

The Fix: Use "Recurring Investments"

This is the single most powerful tool for responsible investing on the app.

Instead of trying to "time the market," you set up an automatic, recurring buy for a set dollar amount. For example, "$25 into VOO every Friday."

- How it works: In the Robinhood app, find the stock or ETF you want to buy. Tap "Trade" > "Buy" > and then select "Set up a recurring investment" in the top right corner.

- Why it's better: This is called Dollar-Cost Averaging (DCA). It automates your investing, removes emotion from the process, and completely breaks the day-trading habit. You are now a long-term investor, not a day-trader.

Mistake 2: Going "All-In" on One Stock

The Problem: You read a headline or see a post about one "hot stock" that's "guaranteed to moon!" You take all your money—$100, $500, whatever—and dump it all into that one company. This is a massive, unforced error. If that one company fails, you lose everything.

The Fix: Use "Fractional Shares" to Diversify

Diversification is the #1 rule of safe investing. Robinhood's Fractional Shares feature makes this incredibly easy.

Instead of putting $100 into one risky stock, you can put:

- $20 into Apple (AAPL)

- $20 into Microsoft (MSFT)

- $20 into an S&P 500 ETF (like VOO)

- $20 into a total world ETF (like VT)

- $20 into your "fun" pick

You don't need to afford a full share that costs $200 or $1,000. You can buy as little as $1 of almost any stock. This lets you build a diversified portfolio (a "basket" of stocks) from day one, which is infinitely safer.

Mistake 3: Chasing Hype and "Meme Stocks"

The Problem: A stock is shooting up 100% in a day. It's all over social media. You jump in, fearing you'll miss out (this is called "FOMO"). The next day, the hype dies, the stock crashes, and you're left holding the bag.

The Fix: Focus on Broad Market ETFs

Want to invest in "the market" without picking individual stocks? Buy an ETF (Exchange-Traded Fund). An ETF is a bundle of hundreds or even thousands of stocks in one.

For most beginners, this is the best place to start. On Robinhood, you can search for and buy time-tested ETFs just like any stock:

- VOO (Vanguard S&P 500): Instantly buy the 500 largest US companies.

- VTI (Vanguard Total Stock Market): Instantly buy every US company.

- QQQ (Invesco QQQ): Instantly buy the 100 largest non-financial companies on the Nasdaq (very tech-heavy).

Make one of these the core of your portfolio. You can set up your "Recurring Investment" (from Mistake 1) to buy an ETF, and you'll be building a more stable portfolio than 90% of hype-chasers.

Mistake 4: Panic Selling at the First Dip

The Problem: You buy a stock. The next day, it's down 5%. You panic. The red on the screen makes you sick. You sell it all "to stop the bleeding." You've just locked in your loss.

The Fix: "Zoom Out" the Chart

This is a mental fix using a literal app feature. When you feel that panic, tap the "1Y" (1-Year) or "5Y" (5-Year) chart view.

You will almost always see that today's "scary" drop is just a tiny blip on a much larger, upward-trending line. Healthy investments go up and down every day, but over the long term, the trend is up. Don't let the 1-Day chart fool you. If you bought a good asset (like an ETF), a dip is a reason to be patient, not to panic.

Mistake 5: Ignoring (or Forgetting) About Taxes

The Problem: You trade all year, make a few bucks, and then get a surprise tax bill in April. You sold a stock you held for only two months? That profit is taxed as "short-term capital gains," which is taxed at the same high rate as your regular job income.

The Fix: Understand and Find Your Tax Documents

Robinhood makes this part easy, too.

- Know the rule: In general, try to hold any investment for at least one year and one day. This qualifies it for "long-term capital gains," which are taxed at a much, much lower rate.

- Find your forms: In the app, go to Account (person icon) > Menu (three lines) > Statements & History > Tax Documents. This is where you will find your 1099 form when tax season comes.

Being a responsible investor means knowing that you will owe taxes on your gains. Plan for it, and don't be surprised.

Conclusion: Use the Tool, Don't Let It Use You

Robinhood is a powerful tool. You can use it to build a diversified, long-term portfolio automatically, or you can use it to gamble on short-term guesses.

The choice is yours. By switching from a "day-trader" to a "long-term investor" mindset and using features like Recurring Investments and Fractional Shares to buy ETFs, you can turn one of the most tempting apps into your most powerful tool for building real wealth.