Public.com entered the brokerage scene with a simple, powerful idea: Investing should be social.

Most brokerages are solitary experiences where you make financial decisions alone. Public flips that model, creating a platform where you can see what your friends, financial experts, and prominent CEOs are buying. It aims to make investing feel collaborative, accessible, and engaging.

For a beginner, this social approach is both Public’s greatest feature and its greatest risk. It lowers the barrier to entry by normalizing investing, but it can also encourage the dangerous practice of speculative trading driven by FOMO (Fear of Missing Out).

The core question is: Does the value of the community outweigh the risk of the herd mentality?

Public’s Social Feed (Community vs. Copying)

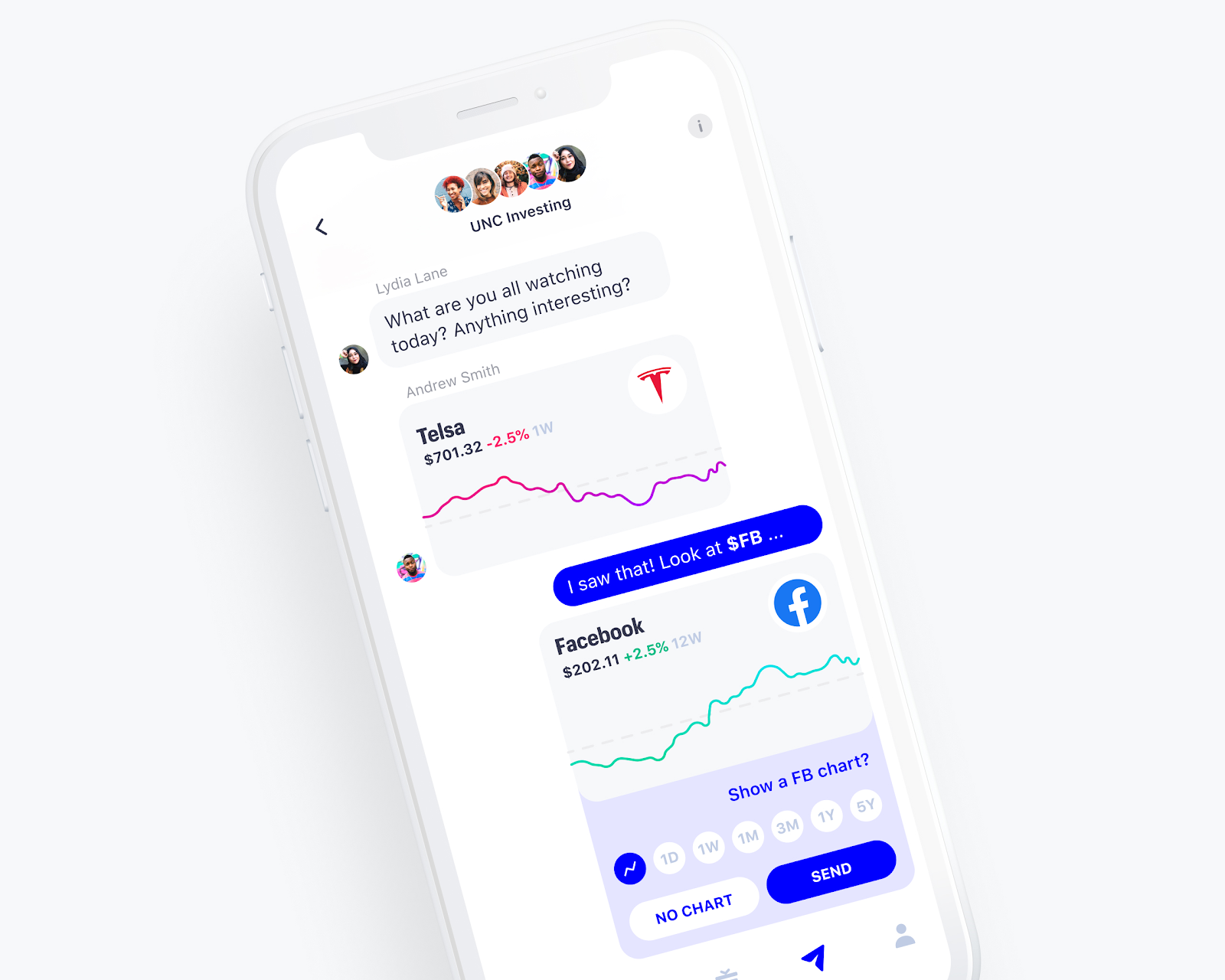

Public is a hybrid of a social media platform (like X or Instagram) and a zero-commission broker. The primary feature is the feed.

1. The Discovery and Education Benefit

The feed is an incredible tool for discovery. Users can browse "Thematic Portfolios" (like "Women in Leadership" or "The Creator Economy"), follow leaders, and read discussions about specific stocks.

- Pro: It takes the fear out of the first investment by showing the beginner what others are doing. It allows you to learn the why behind a trade directly from someone else’s reasoning.

- Pro: The platform emphasizes transparency. When an expert or a friend buys a stock, they must disclose why and how much they are investing.

2. The Risk of the Herd Mentality

The danger of the social feed is that the line between education and speculation quickly blurs.

- The Problem of FOMO: When you see a popular stock shooting up and your entire feed is talking about it, the pressure to jump in is immense. This leads to the Herd Mentality, where beginners buy an asset simply because everyone else is—often without doing fundamental research.

- The Solution: Public has tried to combat this by transitioning to a tipping model (where customers can choose to tip the broker for trades) and focusing its platform on long-term themes, but the social nature itself remains a psychological trigger for fast, often regrettable decisions.

Verdict on the Social Feed: It is worth it only if you treat the feed as a source of ideas and education, not as a direct instruction manual for your own portfolio.

Public’s Value as a Beginner Broker

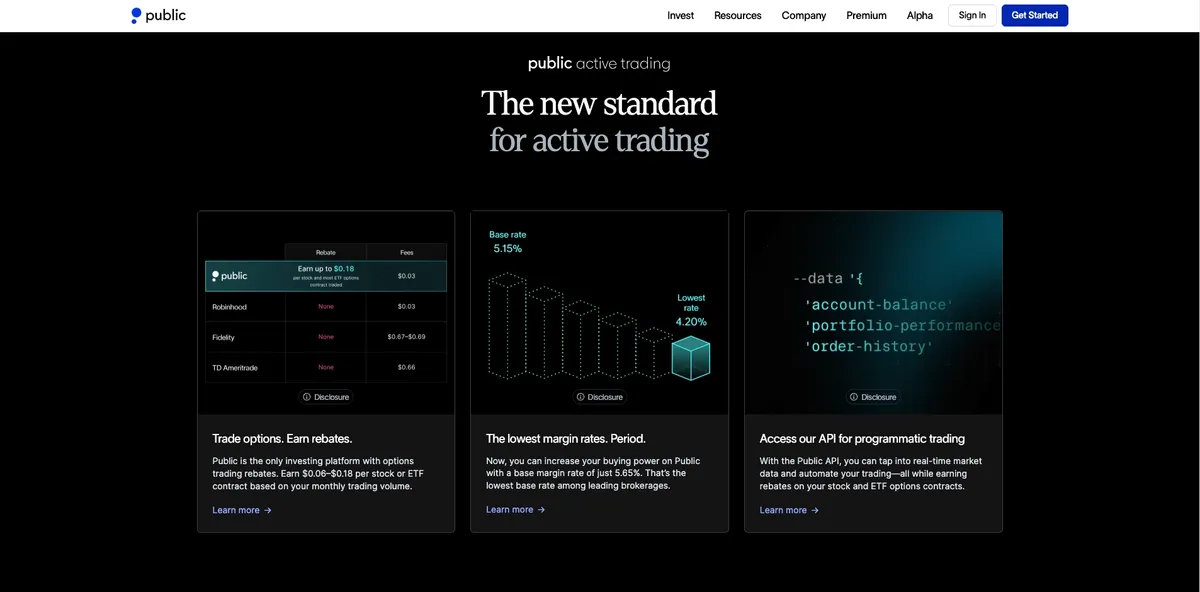

Setting the social features aside, Public is a strong, full-featured broker designed to meet the needs of the modern, small-account investor.

| Core Feature | Public’s Offering | Beginner Value |

| Fees & Commissions | $0 commission on stocks, ETFs, and crypto trades. | Eliminates a cost barrier for regular contributions (DCA). |

| Fractional Shares | YES. You can invest with as little as $1.00. | Allows beginners to diversify immediately across high-priced stocks. |

| Options | YES. Options trading is offered, but with a simplified interface. | Excellent for learning more advanced strategies when ready. |

| Alternative Assets | YES. Offers access to fractional shares of alternative assets (e.g., fine art, collectibles). | A unique way for beginners to diversify outside the stock market. |

| Cash Accounts | Integrated Cash Account offering a competitive high APY on uninvested cash. | Maximizes earnings on emergency funds and uninvested capital. |

Platform Review: Public is built around simplicity, making it intuitive to use. The platform is highly transparent, often stating its commitment to not engaging in Payment for Order Flow (PFOF) for stock trades, which gives customers confidence that the broker is prioritizing execution price over maximizing its own revenue.

Social Investing vs. The Competitors

For a beginner, the decision often comes down to choosing between Public's community, Robinhood's simplicity, or a professional platform like Fidelity's stability.

| Platform | Primary Differentiator | Social Focus | Core Risk for Beginner |

| Public.com | Community & Discovery | High (Primary feature is the follow/discuss feed) | FOMO (Buying based on social trends) |

| Robinhood | Speed & Simplicity | Low (Minimal social features) | Impulse Trading (The app is highly gamified) |

| Fidelity | Research & Stability | None (Purely private investing) | None (Emphasis on long-term research) |

Final Verdict: Is Social Investing Worth the Risk?

Yes, social investing is worth it, but only if you follow the Two Golden Rules of Social Investing:

- Rule #1: Use the Social Feed for Discovery, Not Duplication. Read why someone is buying a stock, then use a third-party platform (like a Fidelity or Schwab screener) to research the company's fundamentals yourself. Never blindly copy a trade.

- Rule #2: Limit Speculation. Dedicate only a small percentage of your overall portfolio (e.g., 5% to 10%) to stocks discovered on the social feed. Keep the bulk of your money in diversified, automated ETFs.

Public is the best execution of the social investing model. It is an excellent, low-cost broker, and its focus on education makes it a great place to start, provided the beginner uses the social feed as a classroom, not a casino floor.