When Netflix made its offer for Warner Bros. Discovery, they made one thing very clear: They hate cable TV.

Netflix wanted the "crown jewels"—HBO, Harry Potter, and DC Comics. But they explicitly rejected the "dying" linear TV channels like CNN, TNT, HGTV, and the Food Network. In their deal structure, those assets were going to be spun off into a separate "bad bank" company so they didn't pollute Netflix's balance sheet.

Then came Paramount.

Paramount’s $30 all-cash offer is for the entire company—including those "dead" cable channels.

Why would Paramount want to own a shrinking business that the smartest tech company on earth rejected?

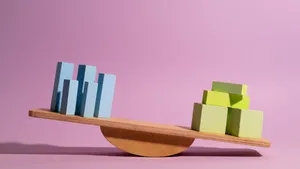

The answer is a masterclass in the difference between Growth Investing and Value Investing.

The "Cigar Butt" Theory

Legendary investor Warren Buffett (a mentor to the folks involved in this deal) has a philosophy called "Cigar Butt Investing."

Imagine walking down the street and finding a discarded cigar butt. It’s gross. It’s soggy. Nobody wants it. But... it has one good puff left in it, and it is free. If you pick it up and smoke it, that puff is pure profit.

The Cable Channels are the Cigar Butt.

- Everyone knows cable is dying. Subscribers are cutting the cord every day.

- However: Before they die, these channels print an obscene amount of cash. CNN, TNT, and HGTV generate billions of dollars in profit (EBITDA) every year from advertising and carriage fees.

Growth vs. Value: Two Different Games

Netflix and Paramount are playing two completely different sports.

1. The Netflix Strategy (Growth) Netflix is a "Growth Stock." Its stock price depends on showing Wall Street that it is growing fast (10% - 20% a year).

- The Problem: Cable channels are shrinking by 5% a year.

- The Decision: If Netflix bought CNN, their total growth rate would slow down. It would make their stock look worse. So, they rejected it.

2. The Paramount Strategy (Value/Cash Flow) Paramount (led by Skydance’s David Ellison) is playing a "Cash Flow" game.

- The Logic: They don't care if CNN is shrinking. They care that CNN generates cash right now.

- The Plan: Paramount can take the billions in cash profit from TNT and HGTV and use it to pay down the debt they took on to buy the company. They are using the "dying" horse to pull the cart for a few more miles.

The "Melting Ice Cube" Risk

Buying a dying business is risky. In finance, this is called catching a "Melting Ice Cube."

You are buying an asset that gets smaller every year.

- If you pay $5 billion for an ice cube, and it melts away before you can extract $5 billion of water (cash) from it, you lose.

- Paramount is betting that these channels will survive long enough to pay for themselves. Netflix wasn't willing to take that bet.

The Lesson for Investors

This drama isn't just about media; it's about your portfolio.

- Are you a Growth Investor? Do you only want to own companies that are getting bigger (like Netflix, Nvidia, Tesla), even if they are expensive?

- Are you a Value Investor? Are you willing to buy "ugly" companies (like oil, tobacco, or cable TV) because they are cheap and pay you cash today?

Netflix wants the future. Paramount is willing to profit from the past. The winner of this bidding war will decide which strategy rules Hollywood.