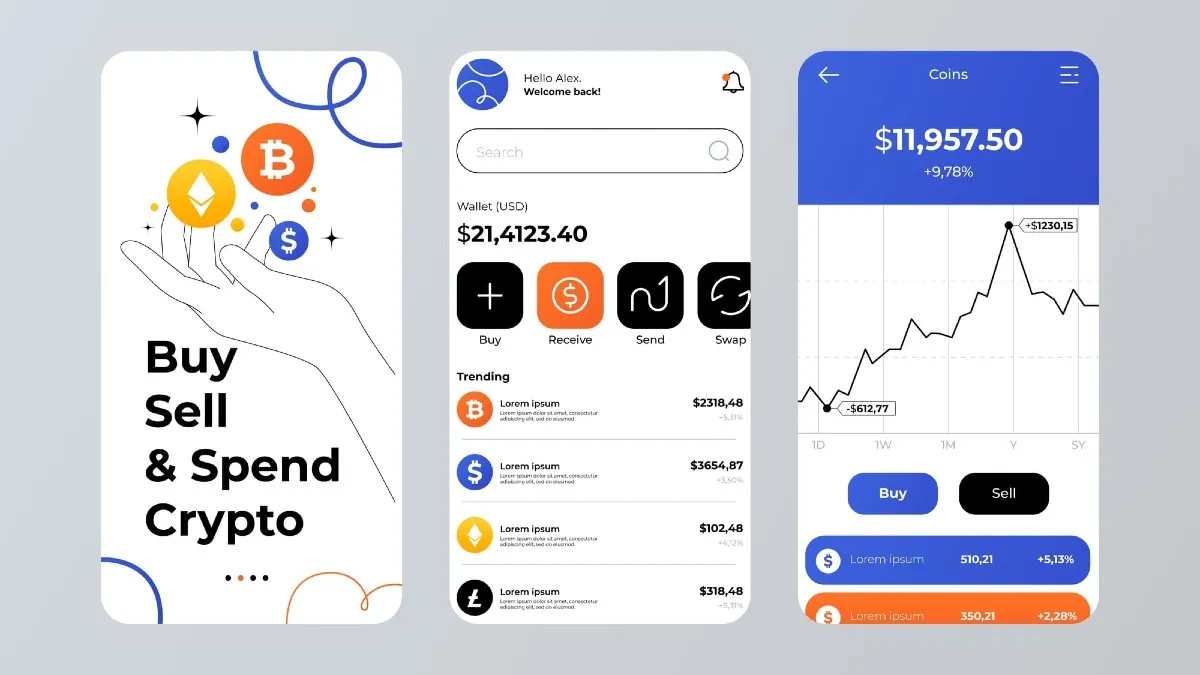

Starting to invest can feel intimidating, but today's financial technology has made it simpler than ever to begin building wealth. The right investment app can guide you, minimize your costs, and help you establish lasting financial habits.

For new investors, the best app is one that balances ease of use with low fees and provides the specific tools you need for your goals, whether you plan to trade stocks or let an algorithm manage your money for you.

What Every Beginner Should Look For

Before choosing a platform, review these key features designed to help new users:

- Low Fees: Most platforms now offer zero-commission trading for stocks and Exchange-Traded Funds (ETFs). Beware of high monthly or annual maintenance fees.

- Fractional Shares: This allows you to buy a portion of a high-priced stock for a small amount of money, removing the high cost barrier to entry.

- Simple Interface: A clean, intuitive mobile design reduces confusion and helps you focus on your investments.

- Educational Content: Look for apps that provide tutorials, articles, or resources to help you learn about market terms and strategies.

The Best Apps, Categorized by Investor Goal

1. Fidelity: Best for Full Service & Retirement

Fidelity stands out as the top all-around choice for beginners planning for the long term. It offers the best blend of low-cost tools and a complete suite of services.

- Key Pros:

- Full range of account types (Roth, Traditional, SEP IRAs).

- Offers its own line of index funds with a $0 expense ratio (like FZROX).

- Excellent research tools and customer support.

- Fractional shares available.

- Key Cons:

- Mobile app is functional but less focused on quick trading than competitors.

- The feature depth can feel overwhelming to absolute beginners.

2. Robinhood: Best for Simple Mobile Trading

Robinhood is famous for its simple, award-winning mobile design. It remains a go-to for investors who want a clean, no-frills trading experience.

- Key Pros:

- Best-in-class mobile user interface (UI) and design.

- IRA accounts now available, complete with a 1% match on contributions.

- Fast execution for quick trades and cryptocurrency access.

- Key Cons:

- Lacks the deeper research tools and educational libraries of full-service brokers.

- The simplified focus can sometimes encourage speculation over long-term habits.

3. Betterment: Best for Automated, Hands-Off Investing

If the idea of choosing stocks feels overwhelming, a robo-advisor is the answer. Betterment creates and manages a diversified portfolio for you based on your financial goals.

- Key Pros:

- Automatic rebalancing and advanced tax-loss harvesting.

- Excellent for goal tracking (e.g., saving for a down payment, retirement).

- No minimum deposit to start.

- Key Cons:

- Charges an annual management fee (approx. 0.25% of your assets), unlike commission-free brokers.

- You have no control over the specific stocks or ETFs purchased.

4. Acorns: Best for Micro-Investing

Acorns is ideal for absolute beginners who struggle to find money to invest. The app encourages consistent saving by making it effortless.

- Key Pros:

- Signature "Round-Ups" feature passively invests spare change from daily purchases.

- Flat monthly fee provides a low barrier to entry for small savers.

- Portfolios are highly diversified through low-cost ETFs.

- Key Cons:

- The flat monthly fee (starting at $3$ to $5) can be a high percentage fee on small balances (under $2,000).

- Limited flexibility in choosing investments.

5. Webull: Best for Practice and Advanced Tools

Webull offers a slightly more advanced platform than simple trading apps, making it great for beginners who anticipate becoming active traders.

- Key Pros:

- Paper trading simulator allows risk-free practice.

- Advanced charting and technical analysis tools.

- Generous extended-hours access (pre-market and after-hours).

- Key Cons:

- Interface is complex for absolute beginners.

- Customer support is primarily digital (chat/email) and lacks the branch network of major brokers.

Which Should You Choose?

The first step in investing is simply starting. All of the platforms listed here provide commission-free access to the stock market. Your choice should reflect your personal approach.

If you want to manage everything yourself, choose Fidelity for its complete range of services. If you prefer a clean mobile experience for basic trading, Robinhood fits well. If you want to put your investments on autopilot, go with a robo-advisor like Betterment.

If your goal is to transition from beginner to active trader, you need practice. Webull is the perfect place to start. Their Paper Trading Simulator gives you the keys to their entire advanced platform—including technical charts and analysis tools—allowing you to practice complex trades risk-free. Once you're confident in your strategy, you can easily switch to live trading on the same robust platform.

Frequently Asked Questions (FAQ)

Q: Are these investment apps safe and regulated?

A: Yes. Every major brokerage listed (Fidelity, Webull, Robinhood, Betterment) is regulated by the SEC (Securities and Exchange Commission) and is a member of SIPC (Securities Investor Protection Corporation). SIPC protects your securities up to $\$500,000$ against the failure of the broker, though it does not protect against market losses.

Q: What is the true minimum amount needed to start investing?

A: For most self-directed platforms (Fidelity, Robinhood, Webull), the minimum is effectively $$0. Because they offer fractional shares, you can start investing with as little as $\$1$ to buy a piece of a high-priced stock.

Q: Which app is best for opening a Roth IRA?

A: Fidelity is the best choice for retirement accounts. It offers the full range of tax-advantaged accounts (Traditional, Roth, SEP IRAs) and provides its own zero-fee index funds (like FZROX) to hold inside your IRA, maximizing your long-term, tax-free growth.

Q: Should I use a robo-advisor or trade myself?

A: If you have zero interest in learning how to pick stocks and want a set-it-and-forget-it, low-maintenance approach, choose a robo-advisor like Betterment. If you are interested in learning and want control over your specific holdings, choose a self-directed broker like Fidelity or Webull.