In today's investing world, holding assets across multiple platforms—perhaps a 401(k) with a previous employer, an IRA at Fidelity, and a cryptocurrency portfolio on Coinbase—is the norm. This fragmentation makes it incredibly difficult to get a single, unified view of your total net worth and true asset allocation.

Fortunately, powerful FinTech apps specialize in securely aggregating all your accounts, from banking and credit cards to complex brokerage portfolios, into one dashboard. These apps use bank-level encryption to link your accounts, allowing you to track performance, fees, and allocation without tedious manual data entry.

Here is a full comparison of the best apps for tracking multiple brokerage accounts, expanded to cover data security and detailed analysis features.

Best Tracking Tools for Investors

The best tracking tools fit into distinct categories based on their primary function: long-term planning, deep analysis, or integrated budgeting.

| App / Service | Primary Focus | Best For | Key Feature for Brokerage Tracking |

| Empower (formerly Personal Capital) | Net Worth & Retirement Planning | Investors focused on long-term retirement health and fee analysis. | Fee Analyzer: Scans investment fees across all linked accounts and suggests lower-cost alternatives. |

| Morningstar Portfolio Manager | Investment Analysis | Investors focused on deep, stock-level research and risk management. | X-Ray Tool: Provides an underlying analysis of diversification, sector exposure, and fund holdings. |

| Quicken/Simplifi | Budgeting & Investment Management | Users who want to integrate investments with comprehensive budgeting/expense tracking. | Tax Lot Tracking: Detailed tracking of cost basis and capital gains across accounts. |

Full Breakdown of the Best Options

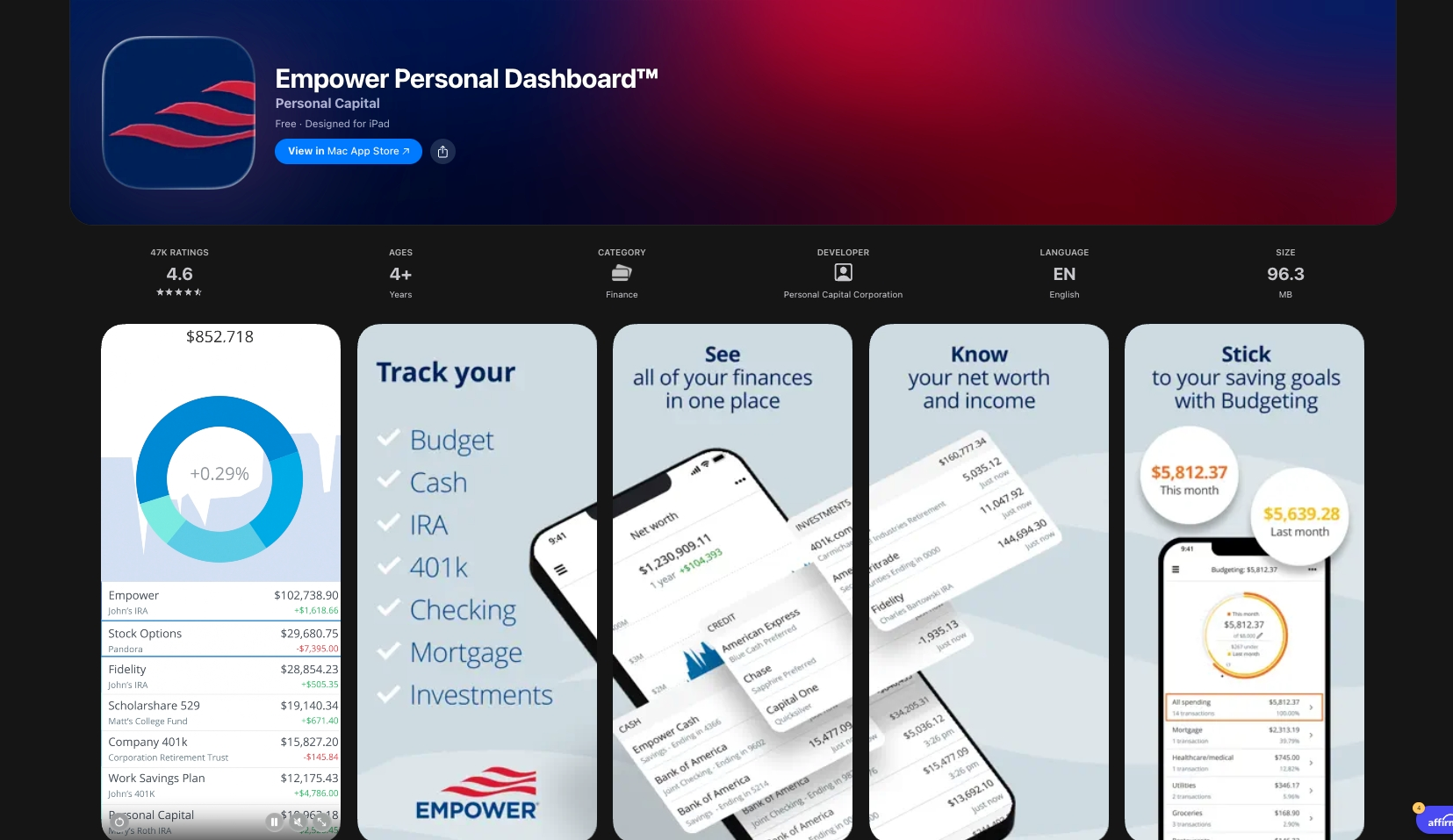

1. Empower (formerly Personal Capital)

Empower is the gold standard for tracking total net worth and retirement health, offering the superior dashboard for visualizing your entire financial picture. The platform is free to use because its business model centers on offering paid wealth management services to high-net-worth clients, though using the free tools is under no obligation.

- Total Net Worth: Aggregates banking, credit cards, brokerage accounts, 401(k)s, annuities, and even estimated home values into one real-time figure.

- Retirement Planner: This free, hallmark tool uses Monte Carlo simulations to stress-test your portfolio against thousands of potential market scenarios. It instantly shows the probability of your current portfolio supporting your desired retirement spending, allowing you to test different savings goals and withdrawal rates.

- Asset Allocation: Users easily see a clear visual breakdown of their portfolio across asset classes (U.S. Stocks, International Stocks, Bonds, Cash) and sectors, which is vital for preventing accidental overexposure in any single area.

- Fee Analyzer: This popular free feature scans the expense ratios of your mutual funds and ETFs across all linked accounts and highlights areas where you are overpaying, often suggesting cheaper index funds.

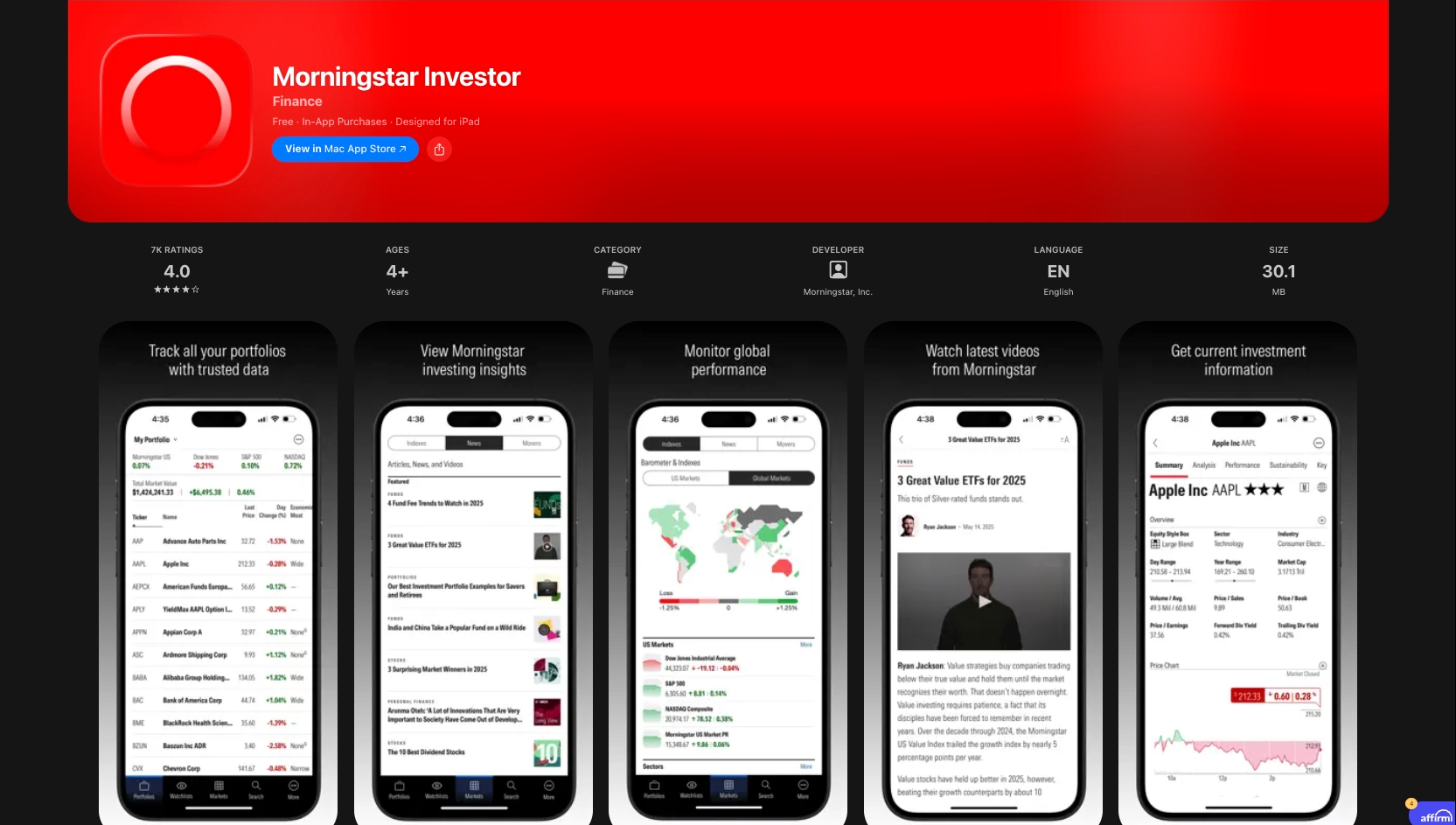

2. Morningstar Portfolio Manager

Morningstar is recognized globally for its deep investment research and ratings. Its portfolio manager is a must-have for active investors and those holding complex combinations of individual stocks and mutual funds.

- The X-Ray Tool: This feature is critical for avoiding "phantom overlap." It allows you to peer inside the mutual funds and ETFs you own across all accounts to see the actual underlying stocks. This prevents you from accidentally owning the same ten tech stocks across five different funds.

- Deep Analysis: Provides detailed data on valuation, risk (like the Morningstar Risk Rating), and sector exposure for every holding. This level of granular data helps the serious investor make truly informed, analytically driven portfolio adjustments.

- Cost: Access to the full portfolio manager is generally part of a paid subscription (Morningstar Premium), but the depth of analysis provided justifies the cost for active traders and fundamental investors.

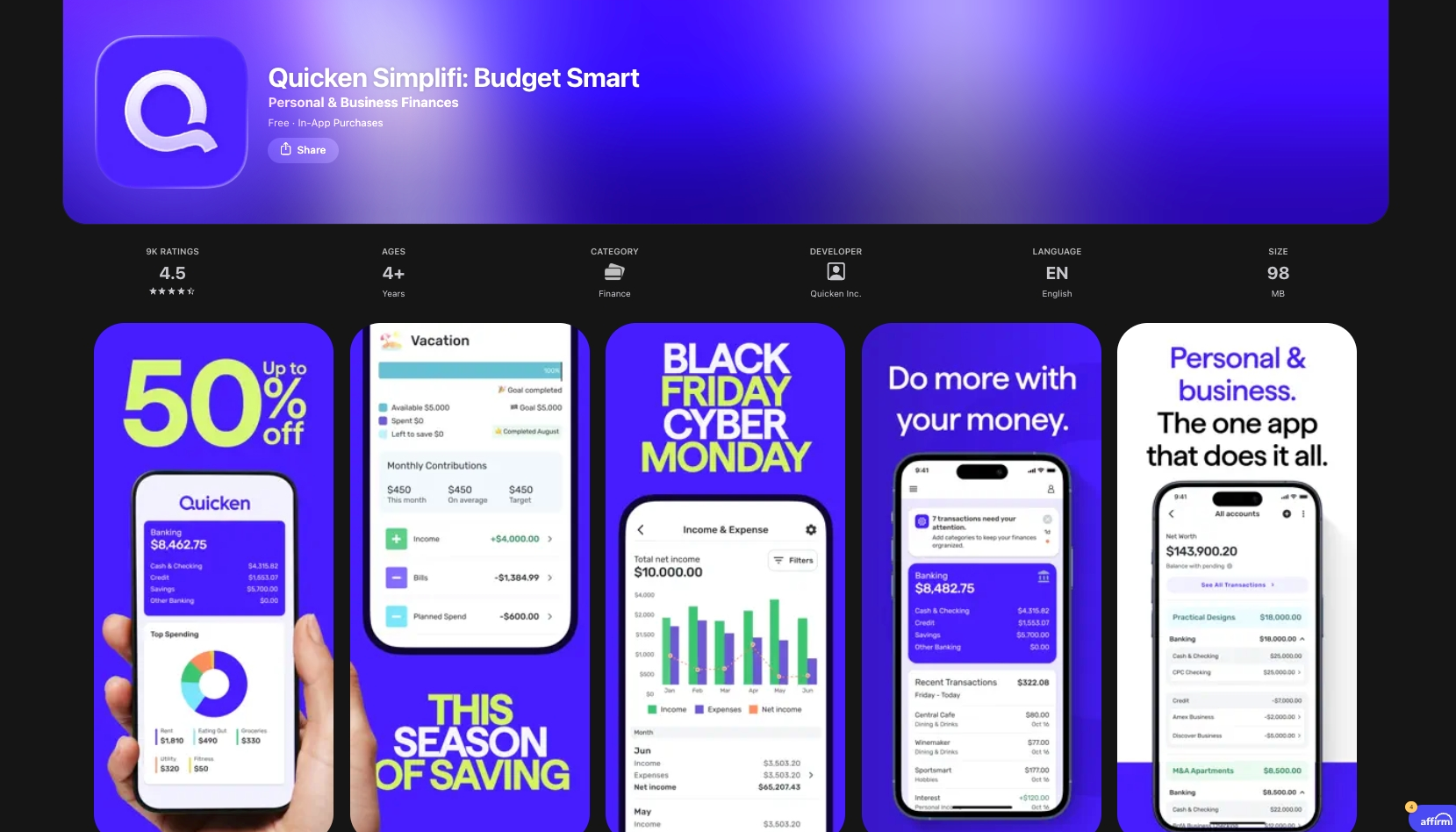

3. Quicken/Simplifi

While Quicken is the long-established leader in desktop personal finance software, its modern, online version (Simplifi by Quicken) provides a cleaner, mobile-friendly experience for users who need both budgeting and investment tracking.

- Integrated Budgeting: Simplifi is built to seamlessly handle both your daily spending and your long-term wealth, all within one application. This holistic view is superior for users who need to track exactly how their monthly budget impacts their investment contributions.

- Tax Lot Tracking: This feature is excellent for managing capital gains. It provides detailed, customizable tracking of the cost basis for specific tax lots across different accounts, helping you execute tax-loss harvesting strategies efficiently.

- Security: Quicken is a financial software mainstay, offering long-term reliability, customizable reporting, and synchronization with thousands of financial institutions.

Security and Data Management

When you link your entire financial life to an app, security is the top concern.

Data Protection Standards

All three services mentioned use bank-level security protocols. They typically employ read-only access—meaning the app can view your balances and transactions but cannot move money, make trades, or access withdrawal functions on your behalf. Data is encrypted both in transit and at rest.

The Aggregation Problem

These apps rely on third-party data aggregators (like Yodlee or Plaid) to connect to financial institutions. While convenient, this sometimes requires sharing your login credentials with the aggregator. Due to industry shifts, many major financial institutions now use secure tokenization (where the app receives a unique digital token, not your password) to link accounts, which is the safer, preferred method.

Conclusion: Choosing the Right Tool

The best app for you depends on your primary financial goal:

- For Retirement Planning and Fee Audits: Empower is the best free option available.4 Its Monte Carlo simulator and Fee Analyzer provide tools previously reserved only for private wealth clients.

- For Deep Fundamental Analysis and Avoiding Portfolio Overlap: Morningstar Portfolio Manager is necessary, particularly if you hold a mix of individual stocks and mutual funds and need to see the assets beneath the surface.5

- For Aggressively Managing Daily Budgets and Investment Contributions: Simplifi by Quicken provides the best all-in-one integration of expense tracking and wealth monitoring.